Getting The Opening Offshore Bank Account To Work

Table of ContentsExamine This Report on Opening Offshore Bank AccountGetting My Opening Offshore Bank Account To WorkThe Of Opening Offshore Bank AccountOpening Offshore Bank Account Things To Know Before You Get ThisAn Unbiased View of Opening Offshore Bank AccountOpening Offshore Bank Account Fundamentals ExplainedOpening Offshore Bank Account Things To Know Before You Get ThisTop Guidelines Of Opening Offshore Bank AccountExamine This Report on Opening Offshore Bank Account

The Panama Documents, papers that were leaked to the general public in 2016, revealed manner ins which numerous rich as well as effective individuals were making use of offshore financial to launder money, dedicate scams and also evade taxes. Some overseas banking clients use their accounts to assist manage their abroad companies as well as financial investments, as well as others could simply invest an excellent portion of their time in a foreign country throughout the year.Select your currency. Opening an account in a various nation will typically imply that you have to utilize a different money to hold, down payment and also withdraw your funds than you would certainly in your residential nation. If you obtain earnings or settlements in an international currency, it can be convenient to make use of a financial institution that runs with that money.

How Opening Offshore Bank Account can Save You Time, Stress, and Money.

Consider just how you want to money and withdraw from your account. Offshore accounts typically featured basic banking functions such as debit cards as well as electronic banking. If you aren't physically in the very same nation as your overseas account, nevertheless, you might need to do things you could not usually finish with a residential account, such as use cable transfers to relocate money or pay international transaction charges or currency exchange charges.

Prior to you open up an account, do detailed study into the financial institution and what's anticipated of you as a customer.

Opening Offshore Bank Account Fundamentals Explained

For instance, financial institutions situated in Switzerland, Luxembourg and also Latvia are typically described as overseas financial institutions. The main advantages of having an overseas account, and also the factors for overseas financial's expanding popularity, are: Convenience as well as versatility the process of opening an overseas financial institution account is significantly faster and easier than when dealing with nationwide financial institutions.

Numerous money having numerous make up various currencies enables you to branch out risk associated with your home currency and also earnings from exchange price changes. Little or no taxation some overseas financial institutions are located in jurisdictions called tax places, where tax obligations on inheritance or earnings are levied at a lower price or not whatsoever.

How Opening Offshore Bank Account can Save You Time, Stress, and Money.

This is feasible thanks to lawful arrangements in these jurisdictions forbiding the disclosure of a client's individual and account details to the authorities, except in the event of a criminal issue (opening offshore bank account). There are some downsides to consider before opening an offshore savings account: Offshore financial is frequently related to tax evasion, cash laundering and ordered criminal activity.

The 7-Minute Rule for Opening Offshore Bank Account

National and also international authorities have actually created numerous grey- and also blacklists read the article in order to tackle unrestrained recommended you read overseas financial. These listings generally consist of territories that decline to co-operate on tax or other matters calling for the arrangement of details on their consumers. As an example, the EU is composing an usual blacklist of uncooperative territories, which should be finalised by September 2017.

As component of our Investec. One Place proposal that gives our clients access to local and also worldwide banking, Investec's South African Private Banking customers * can open up a UK Private Savings account. This account supplies a sterling-based transactional account in the United Kingdom. * leaving out customers whose residency is in a European Union nation.

The Single Strategy To Use For Opening Offshore Bank Account

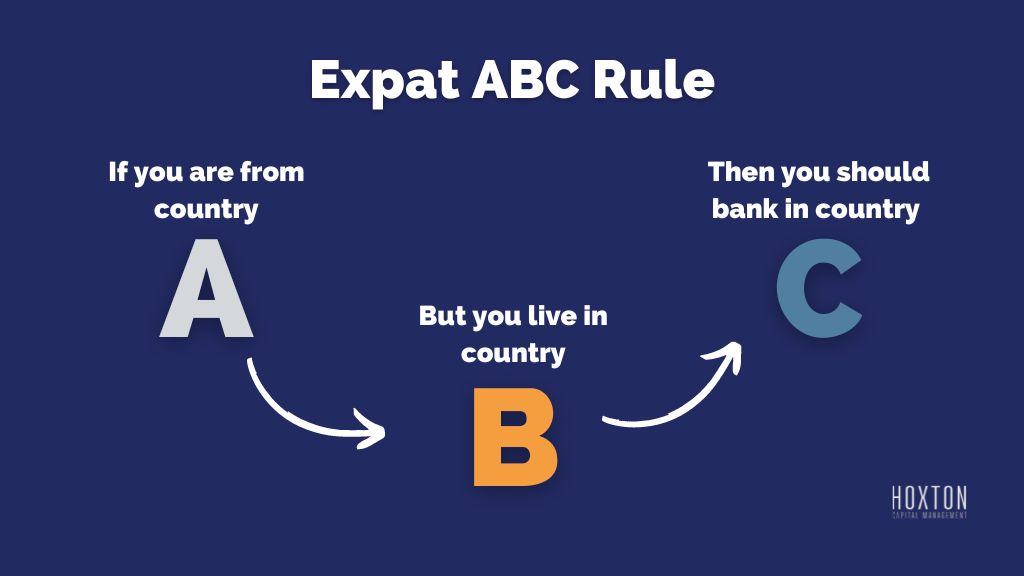

The concern of where to open an offshore savings account is the first point on the mind of anybody considering moving their funds overseas. Are some overseas jurisdictions naturally good as well as others poor? Not truly - but an optimal area for one individual (or organisation) might be downright destructive to another.

If we were to rate offshore regions by international fame, the Cayman Islands would be close to the top of the list. This is due to the fact that the Cayman Islands are a preferred tax haven for the organization elite. For those that bank here, cash earned outside of the jurisdiction does attract an income or corporate tax obligation.

The Greatest Guide To Opening Offshore Bank Account

For extra security, open your account in a Swiss financial institution that does not have branches in your house country. By doing this, if you're wanting to avoid local corruption, no government company will certainly have the ability to apply stress on your bank (opening offshore bank account). What's more, like our previous recommendation, Switzerland has a steady political environment.

While an individual check Full Article out is normally required to open up a checking account in Singapore, some banks have actually started permitting remote enrollment as a result of the ongoing travel constraints. One thing that all high net-worth individuals have in common (past their wealth) is that they're incredibly hectic. Open as well as handle your overseas checking account in Singapore from another location to conserve both money and time.

Examine This Report on Opening Offshore Bank Account

In addition, if you live in Europe or travel there a lot, having an offshore account with a European bank can be very useful. If, nonetheless, you expect a flooding of lawsuits ahead your method, Germany could not be the most effective area for you to open up an overseas banking account.

Seek sanctuary somewhere else if your goal is to defend your properties. Honourable References: Switzerland Singapore Australia The Netherlands The lower line is, you can't think of offshore financial in a dimensionless means. There is no one-size-fits-all option. Bear in mind that you can always seek the assistance of an expert if you're struggling to compose your mind.

Some Known Incorrect Statements About Opening Offshore Bank Account

Selections abound, as well as the choice of where to open up an offshore checking account boils down to every individual's distinct needs. Which one is best for you refers matching a nation to your financial technique.

At Skipton we remember you are an individual, not an account number, There is nothing prohibited or morally wrong with holding an overseas bank account, provided, just like all financial institution accounts, that the funds have been legally gotten which you correctly state passion and any kind of other details as needed by your tax obligation authority.